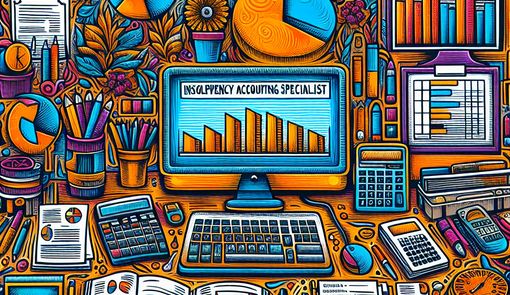

Insolvency Accounting Specialist

An Insolvency Accounting Specialist deals with companies or individuals that are unable to meet their financial obligations. They work on bankruptcy proceedings, manage assets, and provide financial restructuring advice.

Top Articles for Insolvency Accounting Specialist

Sample Job Descriptions for Insolvency Accounting Specialist

Below are the some sample job descriptions for the different experience levels, where you can find the summary of the role, required skills, qualifications, and responsibilities.

Junior (0-2 years of experience)

Summary of the Role

Seeking a detail-oriented and analytical Insolvency Accounting Specialist to join our team. The successful candidate will be responsible for assisting with the management of financial affairs for individuals and businesses during insolvency proceedings. The role provides an opportunity to work closely with experienced insolvency professionals and to develop specialized accounting skills in a dynamic and challenging environment.

Required Skills

- Accounting

- Financial analysis

- Insolvency procedures knowledge

- Attention to detail

- Teamwork and collaboration

- Time management

- Microsoft Excel proficiency

- Excellent written and verbal communication

Qualifications

- Bachelor's degree in Accounting, Finance, or relevant field.

- Understanding of insolvency proceedings and relevant legal frameworks preferred.

- Strong knowledge of accounting principles and financial reporting.

- Excellent analytical and problem-solving skills.

- Ability to work collaboratively in a team environment.

- Proficient in the use of accounting software and Microsoft Office Suite.

- Excellent communication and interpersonal skills.

Responsibilities

- Assist with the preparation of statement of affairs and financial analyses for insolvent entities.

- Support the insolvency team in managing the day-to-day accounting operations for bankruptcy cases.

- Coordinate with various stakeholders including creditors, debtors, and legal representatives.

- Participate in the preparation and review of insolvency reports and documentation.

- Help maintain meticulous financial records and ensure compliance with relevant laws and regulations.

- Assist in the identification and realization of assets to maximize returns to creditors.

- Contribute to the preparation of tax returns and resolution of tax matters for insolvent parties.

Intermediate (2-5 years of experience)

Summary of the Role

An Insolvency Accounting Specialist is responsible for advising and guiding clients through financial distress situations. This role involves working with clients facing insolvency, understanding their financial situation, and developing strategies to manage debt, restructure finances, and, where possible, avoid bankruptcy. The ideal candidate should have a solid understanding of financial and accounting principles, insolvency laws, and experience in financial advisory services.

Required Skills

- Strong analytical and problem-solving skills

- Excellent communication and negotiation skills

- Proficiency in accounting software and Microsoft Office Suite

- Ability to handle confidential information with integrity

- Strong attention to detail

- Capability to work under pressure and meet tight deadlines

Qualifications

- Bachelor's degree in Accounting, Finance, or relevant field required

- Professional accounting certification (e.g., CPA, CFA, or equivalent) is preferred

- Minimum of 2 years of experience in accounting with a focus on insolvency, restructuring, or related field

- Experience with financial analysis and debt restructuring

- Knowledge of insolvency laws and proceedings

Responsibilities

- Assess and analyze the financial position of individuals or companies facing insolvency

- Advise clients on debt management, restructuring, and insolvency proceedings

- Prepare reports and financial forecasts for creditors, courts, and other stakeholders

- Negotiate with creditors on behalf of clients to reach agreeable debt repayment plans

- Oversee the orderly winding up or restructuring of client assets and liabilities

- Stay current with changes in insolvency laws and regulations

- Collaborate with legal professionals on insolvency cases

- Ensure compliance with all relevant laws and ethical standards

Senior (5+ years of experience)

Summary of the Role

We are seeking a highly experienced and knowledgeable Insolvency Accounting Specialist to join our team. The ideal candidate will have a proven track record of managing complex insolvency cases, conducting financial investigations, and providing expert financial advice in insolvency matters. They will work closely with clients, legal professionals, and other stakeholders to navigate the complexities of insolvency, restructuring, and turnaround scenarios.

Required Skills

- Expert knowledge of accounting principles and insolvency practices.

- Excellent analytical and problem-solving abilities.

- Strong communication and interpersonal skills.

- Proficient in the use of accounting and insolvency software.

- Ability to work under pressure and meet tight deadlines.

- Strong leadership and team management skills.

Qualifications

- Bachelor's degree in Accounting, Finance, or a related field.

- Professional accounting designation (e.g., CPA, CA, CIRP).

- Minimum of 5 years' experience in insolvency, restructuring, or a related field.

- Thorough understanding of insolvency laws and regulations.

- Experience in forensic accounting and financial analysis.

- Strong track record of successful case management in insolvency proceedings.

Responsibilities

- Oversee and manage multiple insolvency cases, ensuring compliance with relevant laws and regulations.

- Conduct detailed financial investigations into insolvent companies, identifying assets and liabilities.

- Prepare and present reports on the financial status of insolvent entities to stakeholders.

- Advise clients on the implications of insolvency, restructuring options, and the financial recovery process.

- Coordinate with legal professionals to facilitate the insolvency process, including creditor meetings and court appearances.

- Negotiate with creditors on behalf of insolvent entities to reach favorable settlements.

- Maintain up-to-date knowledge of changes in insolvency legislation and best practices.

See other roles in Business, Consulting, and Legal Services and Finance